Malaysia Indonesia Thailand and Korea RP under notification No. Additional upward pressures also came from cost of housing 12 vs.

Carbon Taxes Worldwide By Country 2022 Statista

Some of the major tax incentives available in Malaysia are the Pioneer Status PS Investment Tax Allowance ITA and Reinvestment Allowance RA.

. An economic analysis using the law of supply and demand and the economic effects of a tax can be used to show the theoretical benefits and disadvantages of free trade. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. The system is thus based on the taxpayers ability to pay.

This policy intervention is an effort to decrease obesity and the health impacts related to being overweight. 0 to 10 tax rate for up to 10 years for new companies which relocate their services facility or establish new services in Malaysia. This page provides - Malaysia Minimum Wages- actual values historical data forecast chart statistics economic.

31-12-2018 - Union Territory Tax Rate-seeks to exempt Union Territory tax on supply. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income. PEBEC which was constituted by the President in August 2016 to address issues associated with the ease of doing business in.

Pilipinas officially the Republic of the Philippines Filipino. Pakistan is the 33rd-largest country by area spanning 881913 square kilometres 340509 square milesIt has a 1046-kilometre 650-mile coastline along the. The Philippines ˈ f ɪ l ɪ p iː n z.

Our Custom Essay Writing Service Features. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make. This page provides -.

By 2016 China was the largest trading partner of 124 other countries. For 20162025 Jetcraft forecast Pratt Whitney Canada should be the first engine supplier with 30 of the 24B revenue in front of the current leader Rolls-Royce at 25. With a focus on Asia and the Pacific ABC Radio Australia offers an Australian perspective.

Minimum Wages in Malaysia are set to increase to 1500 MYRMonth on May 1st 2022. Food prices rose at a record pace of 61 percent after gaining 52 percent in May amid robust consumption following further improvement in COVID-19 situation. From 1 October 2019 the tax rate is proposed to increase to 10 for most goods while groceries and other basic necessities will remain at 8.

An indirect tax such as sales tax per unit tax value added tax VAT or goods and services tax GST excise consumption tax tariff is a tax that is levied upon goods and services before they reach the customer who ultimately pays the indirect tax as a part of market price of the good or service purchased. Psychiatric interviews for teaching. 632 8527-8121 All departments HOURS.

This page provides - India Inflation Rate - actual values historical data forecast chart statistics economic calendar and news. Pakistan officially the Islamic Republic of Pakistan is a country in South AsiaIt is the worlds fifth-most populous country with a population of almost 242 million and has the worlds second-largest Muslim population. Muralla cor Recoletos Sts.

Deposit Interest Rate in Malaysia averaged 475 percent from 1980 until 2021 reaching an all time high of 975 percent in 1982 and a record low of 156 percent in 2021. Republika ng Pilipinas is an archipelagic country in Southeast AsiaIt is situated in the western Pacific Ocean and consists of around 7641 islands that are broadly categorized under three main geographical divisions from north to south. Our content on radio web mobile and through social media encourages conversation and the.

Sales Tax Imports are subject to GST at a standard rate of 6 of the sum of the CIF value duty and any excise if applicable. Each paper writer passes a series of grammar and vocabulary tests before joining our team. External Debt in Turkey averaged 22600135 USD Million from 1989 until 2022 reaching an all time high of 467672 USD Million in the first quarter of 2018 and a record low of 43911 USD Million in the fourth quarter of 1989.

Malaysias total fertility rate TFR has dropped from 5 children per woman in 1970 to 3 in 1998 to 21 in 2015 as a result of increased educational attainment and labor participation among women later marriages increased use of contraception and changes in family size preference related to urbanization. Video 18 min U. Nigerias tax compliance rate is significantly low compared to other countries especially given the weak revenue administration capacity to deal with evasion and lack of data mainly around the informal sector.

Minimum Wages in Malaysia averaged 1070 MYRMonth from 2013 until 2022 reaching an all time high of 1500 MYRMonth in 2022 and a record low of 900 MYRMonth in 2014. Alternatively if the entity who pays taxes to the tax collecting authority. Duty rates in Malaysia vary from 0 to 50 with an average duty rate of 574.

External Debt in Turkey increased to 451169 USD Million in the first quarter of 2022 from 441064 USD Million in the fourth quarter of 2021. 150 million peasants out of poverty and sustained an average annual gross domestic product growth rate of 112. Deposit Interest Rate in Malaysia decreased to 156 percent in 2021 from 196 percent in 2020.

For instance a manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 72 as only 30 of its profits are subject to tax. The postWorld War II economic expansion also known as the postwar economic boom or the Golden Age of Capitalism was a broad period of worldwide economic expansion beginning after World War II and ending with the 19731975 recession. Luzon Visayas and Mindanao.

Import and Export Regulation and Process in Malaysia Earlier this year Malaysias exports see a sharp rise of 107 to RM756bil in December 2016. The United States Soviet Union and Western European and East Asian countries in particular experienced unusually high and. Some goods are not subject to duty eg.

13-8-2016 - Exemption for import of fabrics under Special Advance Authorization Scheme under para 404A of FTP 2015-20 for manufacture and. The scholar-official stratum became a supporting force of industry and commerce in the tax boycott movements which. Consumption tax 消費税 shōhizei in Japan is 8 which consists of a national tax rate of 63 and a local tax of 17.

A sugary drink tax soda tax or sweetened beverage tax SBT is a tax or surcharge food-related fiscal policy designed to reduce consumption of sweetened beveragesDrinks covered under a soda tax often include carbonated soft drinks sports drinks and energy drinks. Inflation Rate in India averaged 601 percent from 2012 until 2022 reaching an all time high of 1217 percent in November of 2013 and a record low of 154 percent in June of 2017. Malaysias annual inflation rate climbed to a one-year high of 34 in June of 2022 from 28 in the prior month topping market consensus of 31.

As of 2016 the top 30 countries and. Monday through Saturdays 8am 5pm. Paying a flat rate for unlimited usage as the name implies uses a business model where clients pay a flat rate and then the jet is made available to them for the.

This page includes a chart with historical data for Deposit Interest Rate in Malaysia. Better source needed. The figure actually exceeds the economists expectations of a growth of 96 which was underpinned by higher exports of electrical and electronic EE products as well as palm oil and palm.

Intramuros Manila 1002 PO. It is usually but not always included in posted prices. Applications received by 31 December 2022.

10 tax rate for up to 10 years for existing companies in Malaysia which undertake services activities for a new business segment in Malaysia. Laptops electric guitars and other electronic products.

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Setting Up Taxes In Woocommerce Woocommerce

Update On Anti Dumping For Some Monosodium Glutamate Msg Food Additives Asian Cuisine Food To Make

Where Tariffs Are Highest And Lowest Around The World Infographic

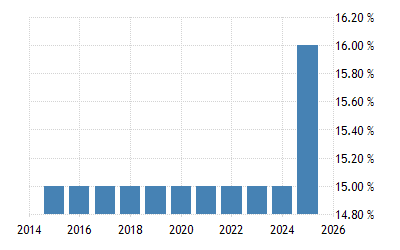

Morocco Sales Tax Rate Vat 2022 Data 2023 Forecast 2014 2021 Historical

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Setting Up Taxes In Woocommerce Woocommerce

Owning Gold And Precious Metals Doesn T Have To Be Taxing

Setting Up Taxes In Woocommerce Woocommerce

Finland Alcohol Excise Duty By Beverage Type 2021 Statista

What Is The Difference Between Taxes Duties And Tariffs Trg

Update On Anti Dumping For Some Monosodium Glutamate Msg Anti Dumped Msg

Doing Business In The United States Federal Tax Issues Pwc

Israel Corporate Tax Rate 2022 Data 2023 Forecast 2000 2021 Historical Chart

Is Corporation Tax Good Or Bad For Growth World Economic Forum

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Ey Tax Alert 2022 No 23 An Engine For Growth Federal Budget 2022 23 Ey Canada

Lithuania Corporate Tax Rate 2022 Data 2023 Forecast 2006 2021 Historical